How can the OECD step up to the threats of climate change?

In a world of international bodies, the Organization of Economic Cooperation and Development might not be one that rises to a household name. Yet, decisions made in its back rooms determine whether most of the largest economies of the world will direct billions of dollars in public financing to fossil fuel projects that push climate change to catastrophic levels.

The public financing in question comes from an obscure form of the government agency known as Export Credit Agencies. ECAs provide billions of dollars in financing to increase their respective countries’ exports, including financing to construct fossil fuel projects abroad. ECAs of OECD-member countries provide tens of billions of dollars in financing for fossil fuel projects which greatly worsens climate change. ECAs of OECD-member countries continue to finance fossil fuel projects despite their national government commitments to combat climate change, including global warming limits contained in last year’s Paris Agreement. Ironic, too, that the head of the OECD has made passionate pleas for the world to end fossil fuel subsidies, while deals are cut within the OECD to ensure these subsidies continue.

Progress is possible. Last year ECAs from OECD-member countries agreed to restrict export credit financing for coal plants. This advancement was an unprecedented recognition of the damage done to the climate from the financing of these agencies. Unfortunately, the agreement contained many loopholes that will allow the finance of at least 40.3 gigawatts of coal projects — the equivalent of adding over 52 million cars to the road.

Today, export credit agencies met at the OECD to consider how to reduce their contribution to climate change. Friends of the Earth provided recommendations for how the restrictions on coal plants agreed to last year can be improved. The restrictions will lack the necessary teeth to have any meaningful impact if these recommendations go ignored:

1. Don’t play favorites — The coal sector understanding must cover all coal projects

The OECD restrictions give a free pass to certain types of coal projects. The restrictions only apply to coal plants, so export credit agencies are free to finance as many projects that relate to the mining, transport and export of coal, as well as other related infrastructure projects. They can even finance the modernization of a coal plant to ensure that those dirty monstrosities that could have otherwise been retired continue to spew out pollution for decades to come. Also, the location of the coal plant can exclude it from the restrictions, which have exemptions for certain types of coal plants in developing countries. These exemptions could allow the financing of projects that would harm local communities and agricultural productivity through air and water pollution, and devastate sensitive ecosystems, even while cleaner alternatives exist.

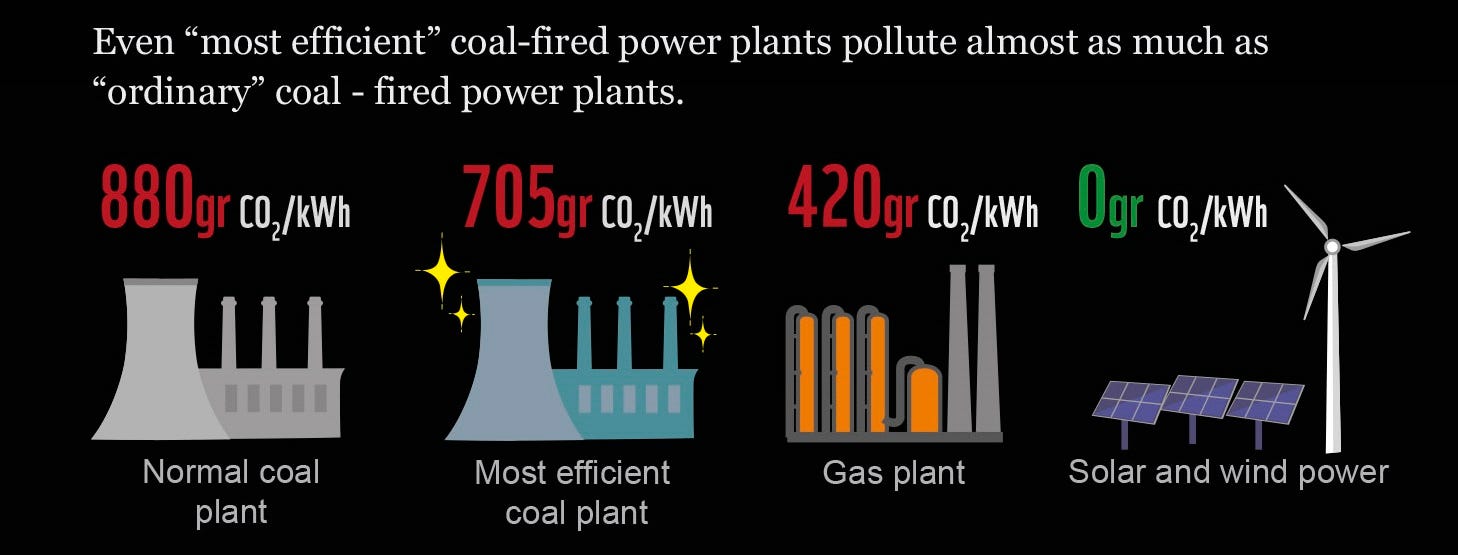

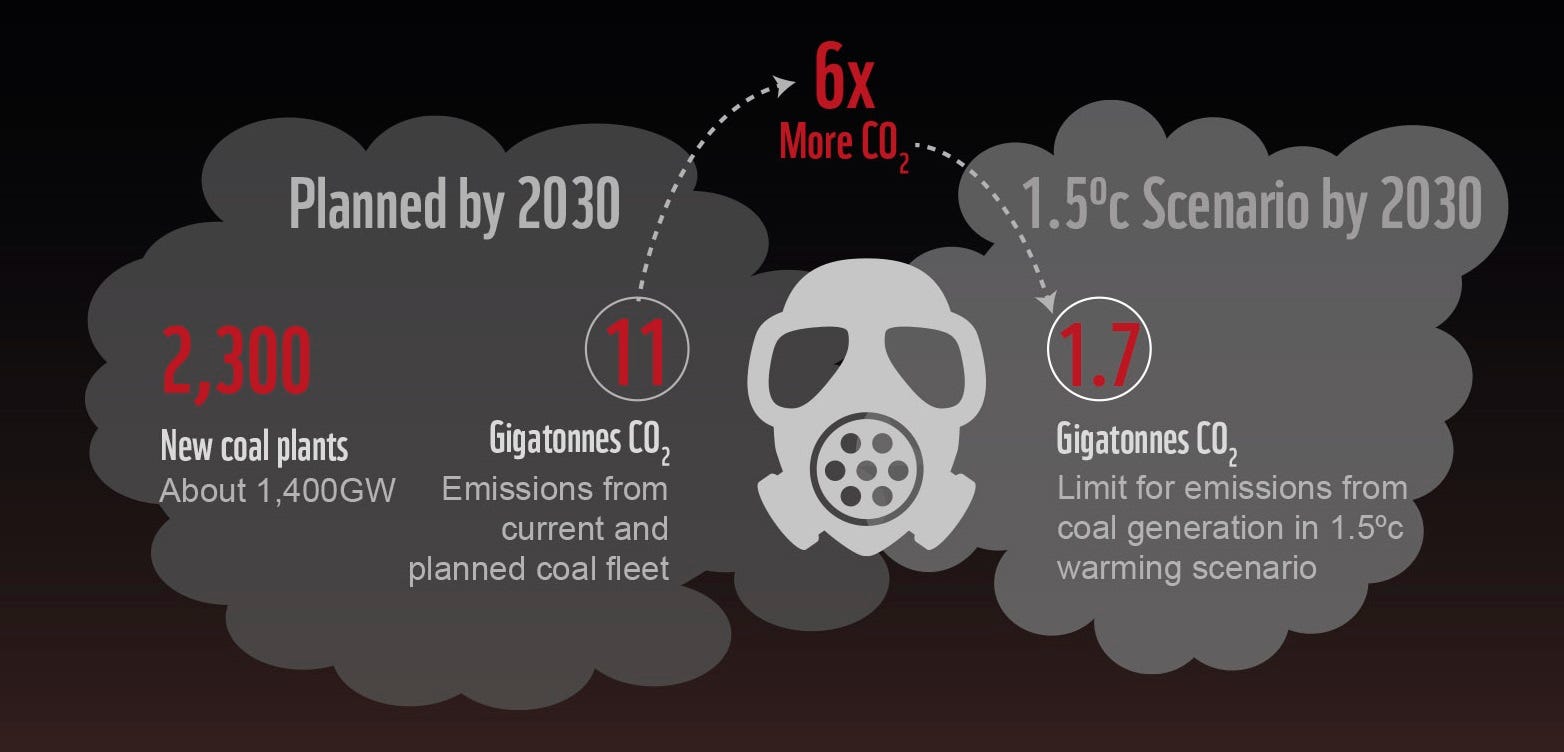

The agreement also gave preferential to treatment for “high-efficiency” coal plants. That makes sense to encourage coal plants that pollute much less, right? Wrong! In reality, high-efficiency plants emit barely any less carbon pollution than the low-efficiency coal plants. Even if these so-called “high efficiency” plants were markedly better, it would be irrelevant. In 2030, the pollution from current coal power plants will be 150 percent higher than levels that would allow us to prevent catastrophic climate change.

2. Don’t forget about oil and gas

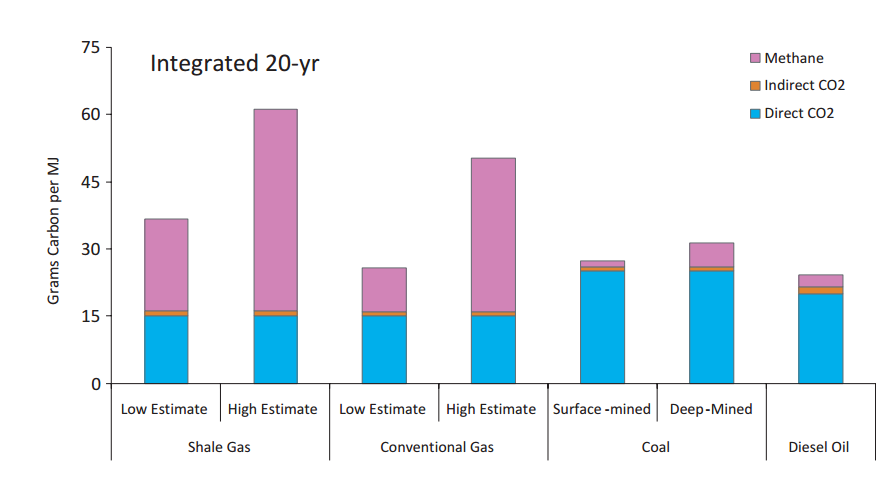

In the fight against climate change, coal is a huge culprit, but oil and gas are often forgotten. Even worse, gas is often wrongly extolled as a solution or a “bridge fuel” in the transition to renewables. In reality, gas, especially when it is liquefied, is a huge problem for the climate. Despite this, export credit agencies are pouring money into these projects. Between 2003 and 2013, members of the OECD export credit group have given over 71.5 billion to oil and gas projects, five times more than to coal. Tragically, this financing is expected to continue. For instance, five export credit agencies are currently considering financing a massively polluting liquefied natural gas project in Mozambique, which will have devastating impacts on the climate. If the OECD wants to actually reduce the impact of export credit agency financing on the climate, then it will need to expand restrictions to cover all fossil fuels.

3. Make these changes immediately — Our climate can’t wait

Public finance institutions are a big part of the climate problem, providing over $73 billion for coal projects between 2007 and 2014. Export credit agencies are responsible for almost half of that. They are the world’s largest source of public financing for harmful extractive, energy and infrastructure projects. ECAs have even greatly exceeded financing for these types of projects by multilateral finance institutions like the World Bank. A recent Oxford study found that as of next year, no more new fossil fuel-fired power plants can be built. Not just coal, but all fossil fuel power plants. That means that export credit agencies must immediately stop financing all coal, oil and gas projects to avert the worst impacts of climate change. Therefore, ending their financing for fossil fuel projects would have a significant effect on mitigating climate change — an important piece of keeping global warming below 1.5 degrees Celsius and honoring the commitments made as part of the Paris agreement last year.

Due to their contribution to the problem, the OECD Export Credit Group plans to review possible changes to the agreement “no later than 30 June 2019.” But that is too late. The climate cannot wait another two or more years before these agencies even consider more restrictions on fossil fuel financing.

Read our full submission to the OECD here.

Related Posts

Ways to Support Our Work

Read Latest News

Stay informed and inspired. Read our latest press releases to see how we’re making a difference for the planet.

See Our Impact

See the real wins your support made possible. Read about the campaign wins we’ve fought for and won together.

Donate Today

Help power change. It takes support from environmental champions like you to build a more healthy and just world.